Badger Meter – Intelligent Water Infrastructure

A Quick Look at Badger Meter

Badger Meter BMI 0.00%↑ (BMI) is a North American market leader in smart water solutions for utility, commercial and industrial markets. The company was originally founded in 1905 when two Milwaukee entrepreneurs developed the first frost-proof water meter for use in the frigid northern US climate. Today, the company sells a comprehensive suite of water meters, valves, sensors, and supporting software for monitoring and analytical purposes. As of 2024, utility markets accounted for roughly 85% of revenue, with approximately 90% of sales generated in the United States with the remaining 10% mainly coming from Asia, Canada, Europe, and the Middle East.

Smart Water Ecosystem

Badger Meter’s family of products are designed with network connectivity and wireless data transmission in mind. Whether it’s mechanical water meters, ultrasonic water meters, or sensors for measuring water quality, temperature, pH, and so on, their products are designed with built-in cellular communication capabilities. It’s worth noting that the company emphasizes that measurement technology does not determine whether or not a meter is smart. Instead, a device becomes “smart” with the addition of a communication device. A mechanical meter could be fitted with cellular radio transmitter while a more modern ultrasonic meter could be read manually. In this example, the older style mechanical meter would be the “smart” device.

One note on mechanical vs ultrasonic meters: Mechanical meters are cheaper up front, but have shorter service lives due to the eventual loss of measurement accuracy over the long term. This loss leads to more water flowing through the meter than the meter reads, creating what is described as non-revenue water (NRW). This increases costs for utilities, as customers are now using more water than they are paying for. Unlike mechanical meters, ultrasonic meters don’t have this issue.

In order to transmit the data collected by the meters and sensors, the company has developed a network-as-a-service (NaaS) solution they refer to as advanced metering infrastructure, or AMI for short. AMI eliminates the need for utility or industrial companies to install or maintain their own communication infrastructure. Through established partnerships with AT&T and Verizon, data from Badger Meter devices can be broadcast over 4G and LTE cellular networks and received by one of the company’s ORION radio endpoints installed at the utility’s control center. In order to view and aggregate the transmitted data, customers can leverage the company’s software solutions.

Prior to digital data transmission, utility companies would have to drive through service territories using a vehicle equipped with radio sensors to collect data emitted from meters. Going back even further, companies would have to have personnel manually verify individual meters, which was inefficient and time consuming. In either case, these processes were done infrequently, limiting the total amount of data collected. Smart meters can be configured to not only send information more frequently, but also send a more diverse set of data.

BlueEdge & Software Solutions

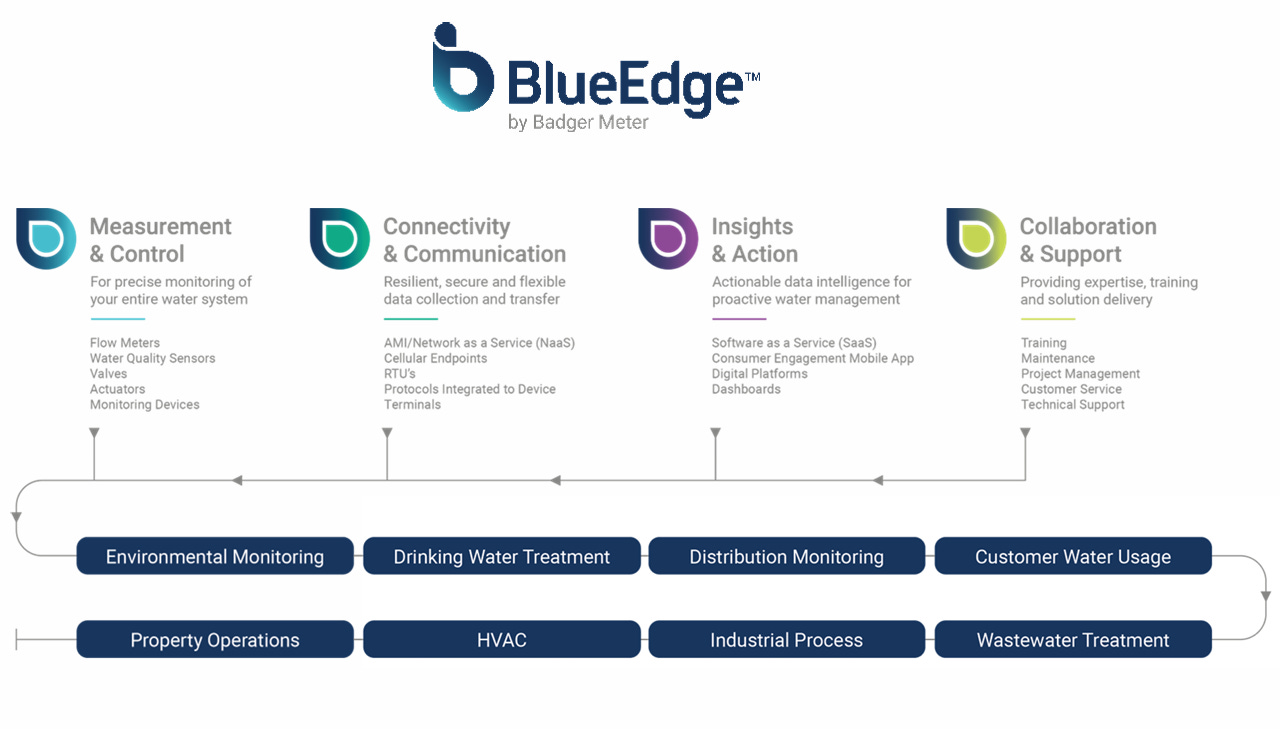

Badger Meter’s latest initiative has been launching BlueEdge, its umbrella suite of solutions that integrate water technology, software, and services. BlueEdge is not a product, but instead a customizable framework used to create personalized ecosystems for customers. The framework is broken down into four components: Measurement & Control – monitor your water system with meters, sensors, and values; Connectivity & Communication – collect your data and transfer it using metering infrastructure and cellular endpoints; Insights & Action – leverage SaaS solutions like BEACON and RADAR to create actionable data intelligence; Collaboration & Support – work with Badger Meter for training, expertise, and maintenance services. Together, these components create better customer integration and experience as well as give Badger Meter a strategic view into where to focus R&D and acquisition efforts.

The company’s main software-as-a-service (SaaS) solutions are the aforementioned BEACON and RADAR suites. BEACON is a utility management cloud-based solution for meter reading, monitoring, and reporting. The software allows for utility operators to view current and historical activity filtered by flow, gateway and endpoint health, system water usage, top accounts by usage, and generate billing reads that can be passed to external billing software. RADAR is used for collecting, analyzing, and alerting on water network data from pressure and flow loggers, water quality systems, and Supervisory Control and Data Acquisition (SCADA) industrial control systems.

Badger Meter’s overall business strategy revolves around selling the smart water equipment up front, then the software to monitor that equipment. This digitized strategy helps lower operating costs for utilities as they can monitor everything from a control center instead of manual data collection. The utility company also gets a greater breadth of data, allowing insights on water usage, leak detection, and when it’s time to replace existing components. This strategy leads to customers creating an entire ecosystem of Badger Meter solutions, increasing product stickiness and potential switching costs. Over the last five years, SaaS revenue has grown at a 28% CAGR.

Investment Thesis

Badger Meter has a number of favorable tailwinds that should enable the business to continue growing at above average rates. Aging US infrastructure will probably be the largest contributor to future revenue growth, especially as environmental regulations for reducing water usage, improving energy efficiency, and addressing water scarcity increase in importance. As of today, AMI adoption rate is estimated to be at only 1/3 of total connections, giving a long runway for future upgrade capacity. Many customers follow an upgrade path where they go from manual reading to radio (AMR), and then from AMR to digital (AMI).

Given that their largest customer is water utilities, the underlying business is relatively stable with low cyclicality. It’s also worth noting that while housing starts do contribute to overall sales, they’re a much smaller contributor than water meter replacement and the adoption of new technologies. The company estimates its total addressable market (TAM) to be around $20 billion, with half of that coming from software. For reference, in the last 12 months (Q3 ’23 to Q3 ’24) Badger Meter has generated sales of $804 million. With software revenue growing quickly and being the higher margin, more predictable, and recurring part of the business, sales and earnings should also continue to grow at stable and predictable rates.

Since 2010, the company has made 13 total acquisitions, with these newly acquired businesses expanding Badger Meter’s ecosystem of software, water quality, and product distribution. These tend to be small tuck-in deals that complement or enhance the existing portfolio of solutions. Noteworthy deals include AquaCue in 2013, which advanced their cellular radio and BEACON software offerings, s::can (not a typo) and ATi in 2020/2021 to expand their real-time water quality monitoring as well as optical and electromechanical sensors, and Syrinix and Telog in 2023/2024 to expand their hardware-enabled software technology. Additional acquisitions could be used to further grow their business or its capabilities.

While a small part of total sales, the industrial side of the business offers some room for future growth. These solutions focus on wastewater handling, heating, ventilation, air conditioning (HVAC), and sustainability. Water-intensive or environmentally unfriendly industries such as chemical manufacturing, fossil fuel refining, and heavy industry could be areas pressed by increasing regulations, although these are also mature and low growth markets.

International expansion is another lever for future growth, and the company believes there are considerable opportunities in developed markets like Europe and regions of the world where water is scarcer, such as the Middle East.

Putting it all together, Badger Meter mainly serves a stable, low volatility industry that is operating aging infrastructure components due for upgrades. The upgrades offered by Badger Meter though its smart water solutions provide efficiencies for the utility companies, and also entrench Badger Meter into their day-to-day operations. As the installed base of equipment increases, software sales also increase, and the customer becomes further embedded into Badger Meter’s ecosystem. Acquisitions can be used to expand their portfolio or enhance existing solutions. The company also has opportunities to expand its industrial solutions and international presence.

Risks

The main risks that come to mind with Badger Meter are poor capital allocation (acquisitions) and competition. Like so many of the other businesses talked about on this Substack, when it comes to acquisitions there is always the risk that management may overpay for deals, or even worse, make large inorganic deals that are difficult to integrate with the existing business. Over the last decade Badger Meter’s team has done a pretty good job of making synergistic and relatively small deals, excluding their large 2012 acquisition of Racine Federated.

Competition is another meaningful risk for Badger Meter. In utility water meters, they are fortunate to operate in an oligopolistic market, with themselves, Roper Technologies’ Neptune, and Xylem’s Sensus making up 85% of the North American market. However, when it comes to areas such as water quality and flow instrumentation, the list of competitors is much larger. Many of their competitors are also larger and possess greater financial resources than Badger Meter. Despite these challenges, the company believes their niche, specialized focus combined with favorable patents enable them to out-compete others.

Conclusion

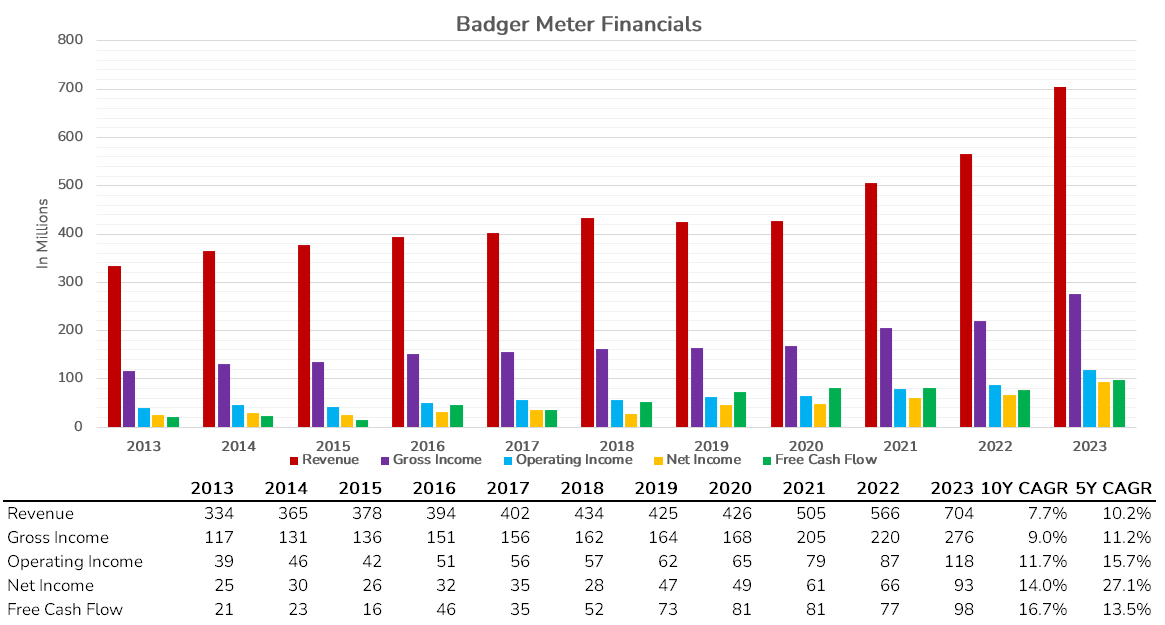

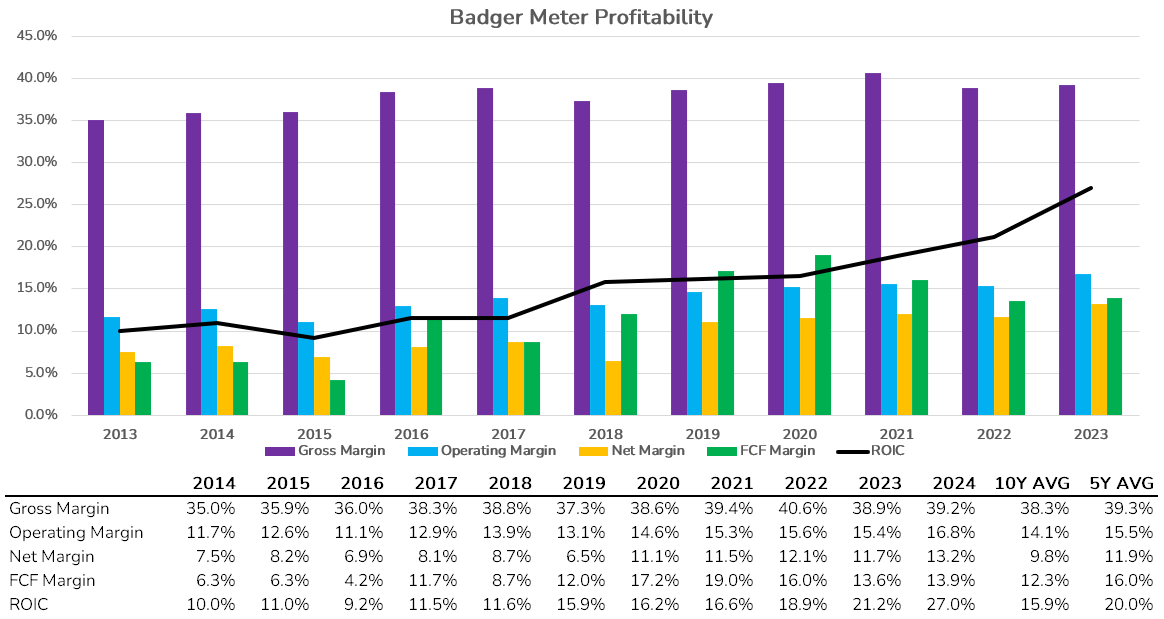

Badger Meter offers investors a great way to play US water infrastructure, scarcity, and environmental trends without needing to invest in capital-intensive utility companies. Software revenue has continued to accelerate in recent years, achieving a 5-year CAGR of 28% and up 34% YTD in 2024. Following the growth of software sales, margins and return on invested capital have also improved. With only 1/3 of total connections supporting AMI today, there is a long runway for additional growth. The company’s BlueEdge framework highlights the smart water ecosystem they’ve built as well as creates a straightforward way to sell their solutions to customers.

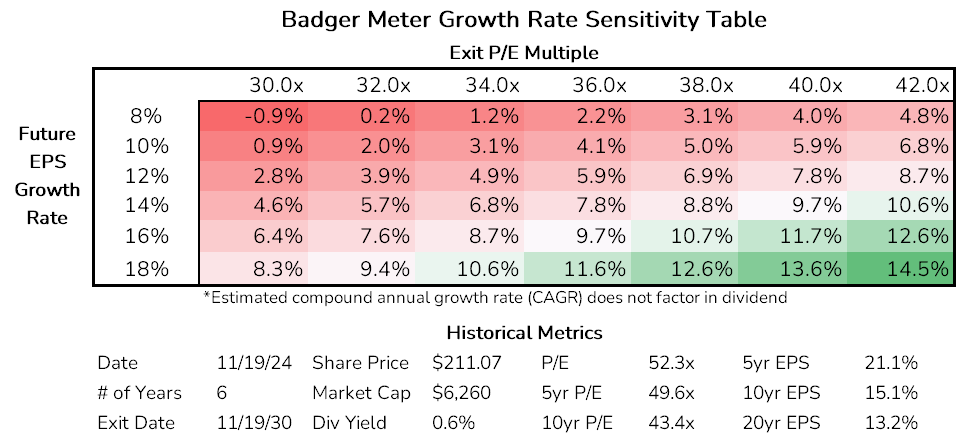

The largest hurdle to investing in Badger Meter is the stock’s valuation. The stock currently trades north of 50x earnings, although its 10-year average P/E is also high at around 43x. Growth has accelerated in recent years, but seems unlikely to sustain these rates over the medium or long term. Its strong position in the water meter market and the stickiness of its solutions can probably generate low double digit EPS growth over a relatively long-time frame, but it’s difficult to see how the current valuation can be justified. As seen in the sensitivity table below, even an EPS CAGR of 18% for the next 6 years generates lackluster returns assuming the multiple contracts.

Supporting Visuals

Relevant Links & Sources

Disclosure

This post expresses opinions solely of the author. The author is not receiving compensation on behalf of and has no business relationship with any company whose stock is mentioned in the post. Data, forecasts, and predictions shared in this post are for informational purposes only and are not guaranteed to be accurate or correct. This post is not an endorsement to buy, hold or sell. Investing carries risk. Always do your own due diligence before making investment decisions or putting capital at risk in the market.