Copart – From Salvage to Sold

A Quick Look at Copart

Copart CPRT 0.00%↑ (CPRT) is the largest online auction and vehicle remarketing service company in the United States. The company’s services primarily involve handling damaged and totaled vehicles on behalf of insurance companies, including transportation, title processing with state DMVs, storage, and the eventual sale to vehicle dismantlers, rebuilders, and used vehicle dealers. To support these operations, the company geographical footprint encompasses approximately 19,000 acres of land zoned for vehicle salvage. While predominantly operating in the United States, the company has also worked to expand internationally, serving customers in Canada, the UK, Ireland, Germany, Spain, Brazil, and others.

Junkyard Middleman

Copart’s primary customer base is insurance companies, which account for approximately 80% of salvage volume and ~1/3 of revenue. Other customers include banks, fleet operators, and vehicle rental companies. The largest 5 to 6 auto insurance companies make up the bulk of these figures, giving Copart a relatively concentrated customer base. To maintain strong relationships, the company is careful with price increases and fees charged to insurers, preferring to focus on long-term trust and stability instead. Greater fragmentation on the buyside (dismantlers, rebuilders, repair licensees, exporters, used vehicle dealers) enables stronger pricing power on this side of the business, allowing for Copart to be more aggressive with its fee structure. Out of these customer groups, it is estimated that vehicle dismantlers are the largest of the bunch.

While buyers don’t particularly enjoy Copart’s fees, the company’s middleman role is advantageous to all parties involved in the salvage industry. For insurers, Copart handling the physical assets allows for agents to focus on processing claims and helping customers. It’d be unrealistic for insurance companies to attempt to internalize these processes, as they’d need to transport, process, and store all of the salvaged vehicles. These operations would be costly and inefficient, as individual insurers likely wouldn’t have the land and throughput to justify the overhead of internalization. Additionally, they would need to establish a network of buyers to sell to. Copart’s large online auction platform and customer base creates a double-sided network effect where more buyers benefit sellers due to increased bidding and more sellers means more opportunities for buyers to find specific vehicles to purchase.

Salvage Yard Expansion

One of Copart’s biggest advantages is its vast network of owned and zoned salvage yards. Unlike top competitor IAA (recently acquired by RB Global), Copart’s strategy has always been to own their land outright as opposed to leasing it. Today, the company operates on approximately 19,000 acres of land, with 90% (17,100 acres) being owned and the remaining 10% being leased. In contrast, IAA leases about 90% of land, owning only around 10%. Owning land is a lot more predictable than having to negotiate new leases every several years, making it the more favorable long-term strategy. Copart has also been active in adding to new locations, having doubled its total acreage since 2015 and emphasized expanding capacity in areas at high risk of natural disasters (per Morningstar).

When it comes to natural disasters, it may come as a surprise that Copart actually tends to incur a loss on serving these events. This is primarily due to high labor and sub-haul costs, which can exceed revenue from additional vehicle volume (per Morningstar). Despite this, the company is committed to continue serving large-scale disasters, as management believes reliable customer service helps maintain strong relationships with insurance companies. Following Hurricane Harvey in 2017, which stalled over Texas and created catastrophic flooding, Copart and IAA combined to sell over 150,000 vehicles damaged by the storm.

To accommodate these large swings in volume, the company tends to keep around 30% of land in catastrophe-prone areas idle, as well as ~15% in non-catastrophe areas. Keeping a sizable percentage of land sitting idle creates significant flexibility at the expense total utilization, and ensures that the company can always support insurance companies during unprecedented times. This strategy also creates another hurdle for new entrants to the industry, as they would likely be unable to afford to keep land idle, and simultaneously be poorly positioned to provide support when it’s needed most, such as during natural disasters.

Investment Thesis

There are a few key growth drivers that make Copart a compelling opportunity moving forward. The first major factor is that its network of owned salvage yards, combined with its large online auction platform, creates significant barriers to entry for new competitors. The capital costs to replicate their yard network would be enormous, assuming it would even be possible to acquire enough land in favorable locations. This competitive advantage is similar to that of Republic Services and the other large environmental service companies, who own vast networks of landfills and waste transfer stations. The online network of buyers and sellers would also be difficult to disrupt, as insurers want more bidders for better sale prices and buyers want more vehicles to be able to bid on. Both of these factors would make convincing either set of parties to switch vendors a challenge.

Another factor that can contribute to future growth for the company is increasing loss ratios on newer vehicles. Since the 1970s, in general accident rates have trended down due to greater safety features, enhanced sensors, and more overall technology. However, total loss frequencies have risen due to rising repair costs from those very same expensive parts alongside higher labor rates. This means that even in minor accidents insurers may write cars off rather than opt to have them repaired. Since Copart generates fees on vehicles sold, an increase in totaled vehicles is a favorable trend. It’s also likely that newer vehicles can go for higher prices at auction, which works in Copart’s favor in scenarios where they are capturing a percentage of the sales price.

Copart’s skilled and long-term focused management team are another reason investors should expect long-term success for the company. Not only did they prioritize owning land as opposed to leasing it, they were also early adopters of using computers, technology, and the internet to manage their business systems. This early adoption, combined with first creating their online auction site in 2001, were driving factors in helping the company capture and consolidate market share early on. The latest version of their auction platform, VB3, allows for streaming real-time sales data to buyers and sellers, allowing sellers to respond on a national scale and buyers to participate from anywhere at any time. Management continues to look for ways to expand its technology platform, add new value-added services for online payments, mobile apps, and virtual sales.

The company will also continue to pursue global, national, and regional vehicle seller agreements with insurance companies, banks, and other institutions to sustain long-term growth. Copart can promote their strong buyer network in addition to the company’s own ability to achieve high net returns in order to sign additional long-term deals. However, it’s worth noting that given the company’s already dominant position, it may be difficult to capture further market share.

And lastly, international markets provide new opportunities abroad for the company, particularly in developed regions like Europe. These markets tend to be fragmented, allowing an opportunity for a large, focused, and efficient player like Copart to leverage a similar playbook as used in the US to quickly scale up operations in new countries.

Risks

There are a few risks worth considering with Copart’s business. First, there is the eventual risk of self-driving vehicles reducing accidents to a near negligible rate, which would greatly reduce salvage volumes. However, this is likely decades away from being a concern, as even if self-driving becomes normal within the next decade, widescale adoption rates will likely take much longer. Another risk is that they’ve reached their limits in how much market share they can take from competitor IAA. Insurers likely wouldn’t want to turn Copart into a monopoly, and perhaps IAA’s parent company RB Global can realize synergies with the business and improve operations. Both of these factors could reduce Copart’s growth rates, which may not hurt the company too much but could hurt stock performance.

Another consideration is that a major recession could cause both declining vehicle prices and lower vehicle volumes from lower loss rates. The combination could greatly slow company performance, although this isn’t a permanent risk to the business. Lastly, international expansion could prove to be more complex and less profitable due to different rules and regulations surrounding insurance and salvaged vehicles abroad.

Conclusion

Copart is a very well-run company operating in a niche industry backed by high barriers to entry. The company serves as a middleman between insurance companies, banks, vehicle dismantlers, and rebuilders, but doesn’t face risk from these groups attempting to internalize these operations. Between the volume of land needed, administrative duties, vehicle storage, and high volumes needed to justify operational overhead, it’s simply easier for these groups to outsource and collaborate with Copart. There are some terminal risks to the business, such as self-driving cars, but most major threats are decades away from becoming a meaningful concern.

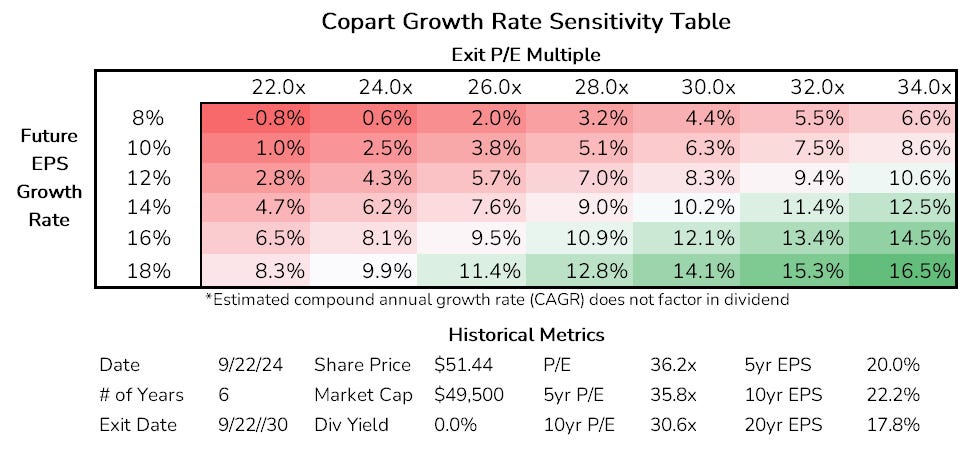

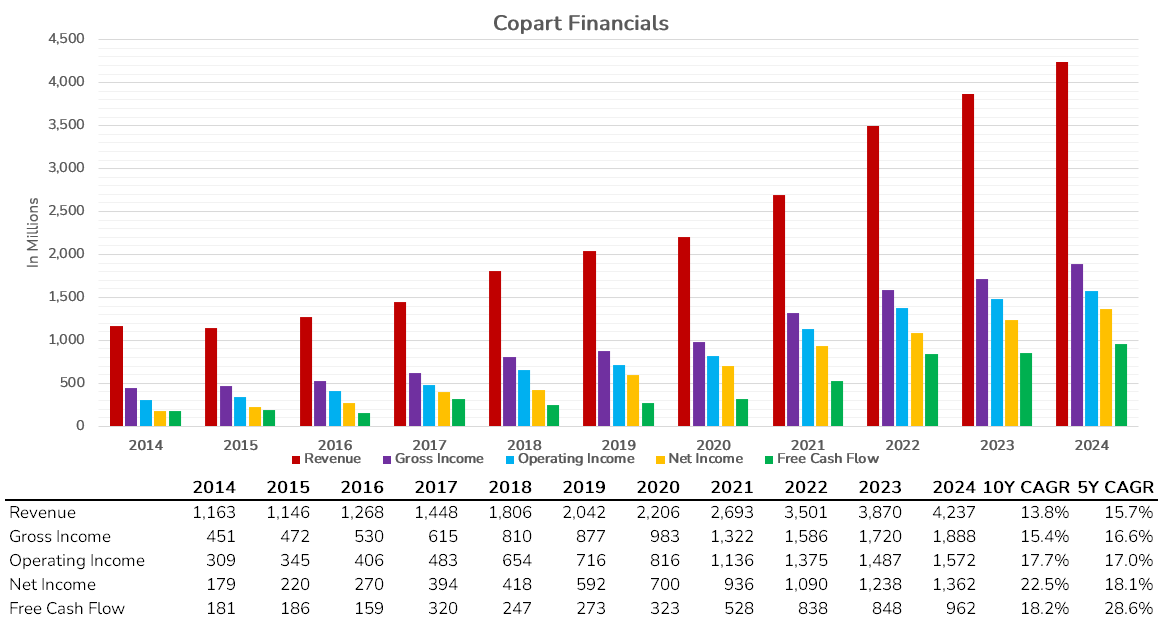

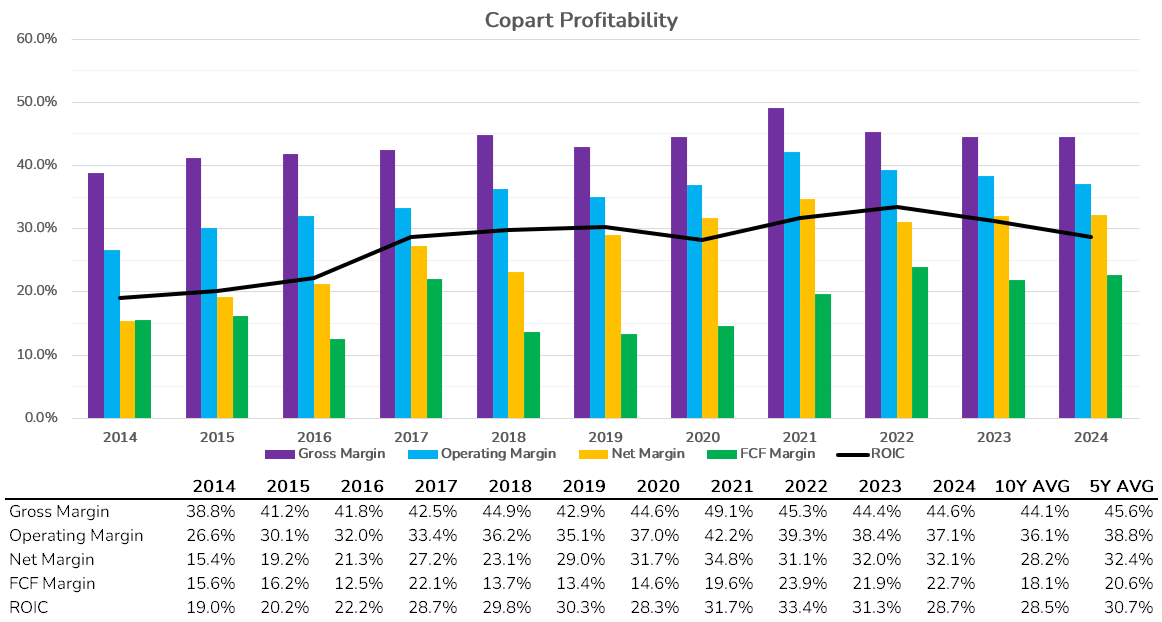

The stock is relatively expensive, but has also exhibited strong growth, limited cyclicality, an ever-growing set of competitive advantages, and steadily improving financial metrics. Given these factors, it’s difficult to determine what a fair value for the company’s stock would be. Over the last decade, multiple expansion has played out well for existing shareholders, although there may not be much additional room for that moving forward. However, future growth expectations for the company remain relatively strong, with analysts expecting mid-double-digit EPS growth in the coming years. Assuming little to no multiple compression, the current valuation actually isn’t unreasonable. However, at that point you are putting increased emphasis on the market’s perception of the business as opposed to the underlying performance itself. A near-term reversion to the stock’s 10-year average P/E ($47-$48/share on a forward basis) looks to be a more sensible entry point for investors.

Supporting Visuals

Relevant Links & Sources

National Safety Council article on accident rates

Disclosure

This post expresses opinions solely of the author. The author is not receiving compensation on behalf of and has no business relationship with any company whose stock is mentioned in the post. Data, forecasts, and predictions shared in this post are for informational purposes only and are not guaranteed to be accurate or correct. This post is not an endorsement to buy, hold or sell. Investing carries risk. Always do your own due diligence before making investment decisions or putting capital at risk in the market.

One could argue that although self driving cars do present a terminal risk, the actual car salvage market should still sustain itself. As we have seen, electric vehicles have more expensive one time maintenance costs, and it remains to be seen if the battery market continues to become more efficient. A question I am asking myself is, “as EVs hit their battery life, will people want to buy them used, rather than upgrading to a new one?” I think the bigger risk posed is insurance companies not trying to create a monopoly. Still, it’s a very difficult space to enter due to the capital requirements of owning large tracts of land. Interesting read.

Im not so sure about the "new" CEO. Would watch his performance for a year or two first.