Ingersoll Rand – Industrial Evolution

Formed through the merger of Gardner Denver and Ingersoll Rand's industrial business in 2020, Ingersoll Rand IR 0.00%↑ has become an industry leader in mission-critical flow creation technologies. While typically thought of as a traditional industrial business, management has been actively reshaping the company to generate higher quality revenue streams, increase exposure to faster growing industries, and modernize their equipment through the use of software.

Business Overview

Ingersoll Rand is a manufacturer of mission-critical flow creation technologies, providing solutions for handling air, gases, liquids, and solids. The majority of sales come from compressors, but they also sell vacuums, blowers, power tools, and lifting equipment. Due to the company’s long history, high reputation, and broad product catalog, they have a large, global base of installed equipment, allowing for modest aftermarket and service revenue (~36% of sales in 2023).

Ingersoll Rand equipment is typically just one component in a much larger system, making the company’s parts a relatively small portion of the customer’s overall bill of material. This small portion in combination with the mission-critical nature and harsh environment exposure that many parts face leads to frequent wear and tear, and in turn customers replacing like-for-like components.

From an organizational standpoint, the company operates through two segments:

Industrial Technologies and Services (IT&S) sales are about 60% equipment, 40% aftermarket, and accounted for ~82% of company revenue in 2023.

Precision and Science Technologies (P&ST) sales are about 80% equipment, 20% aftermarket, and accounted for ~18% of company revenue in 2023.

Ingersoll Rand’s latest strategic initiative has been building software solutions that integrate with the company’s compressors and other equipment. This industrial internet of things (IIoT) software platform allows for compatible equipment to be monitored remotely for issues as well as perform predictive analysis to ensure proper maintenance and correct service intervals. The company believes this software can increase the aftermarket opportunity for connected compressors by as much as 25%. Additionally, these digitally integrated solutions can increase the stickiness of their physical product offerings.

Management Team

Ingersoll Rand boasts an impressive management team, led by CEO Vicente Reynal. Vicente became CEO of Gardner Denver back in 2017 and oversaw the merger process in 2020 as the company combined with Ingersoll’s industrial segment. Notably, he is also a former Danaher executive who worked at the company for 11 years in various roles. Prior to that, he was an executive at Thermo Fisher Scientific. He has a bachelor’s degree in mechanical engineering from Georgia Institute of Technology and a Master of Science in both mechanical engineering and technology & policy from MIT.

Ingersoll Rand also has three other executives that formerly worked at Danaher, one of which is also an engineering graduate from MIT. Three other members of the executive team have been at the company for 16 or more years including one that worked their way up through various engineering and supply chain/logistics roles. Across the board, there are many executives with degrees and backgrounds in science and engineering, especially electrical and mechanical engineering. While it may sound trivial to point out education, there are quite a few companies out there where many of the executives come from a finance or business background as opposed to technical education and experience.

Given the presumably heavy influence Danaher has had on shaping the current leadership team, it’s no surprise the company has developed a continuous improvement system called Ingersoll Rand Execution Excellence (IRX), which appears to take inspiration from the Danaher Business System (DBS).

Evolution Through Acquisitions

Over time, Ingersoll Rand’s strategic, acquisition-heavy strategy has begun evolving the business into more than just an industrial manufacturing company. Since officially forming in 2020, the company has completed over 25 acquisitions, many of which have a science & technology focus in addition to an emphasis on recurring revenue. A few of their noteworthy acquisitions have been as follows:

In 2022 they acquired SPX FLOW’s air treatment business for $525 million. The business is a leading manufacturer of desiccant and refrigerated dryers, filtration systems, and purifiers for dehydration in compressed air. Notably, the sales mix is about 51% original equipment and 49% recurring and aftermarket revenue. From CEO Vicente Reynal at the time of the deal,

“Compressed air dryer and filtration equipment helps increase the production and process reliability of the compressor and continues our strategy of expanding our product offerings in the broader compressor ecosystem. The business is highly complementary.”

Ingersoll Rand also acquired Westwood Technical in 2022, a control and instrumentation specialist based in the United Kingdom. This deal helped them expand their IIoT software offerings by leveraging Westwood’s Aircom product line. Aircom is a self-contained, battery-powered communications device used to transmit data from assets in remote and challenging locations for monitoring and control applications.

They have also made various tuck-in acquisitions along the way to continue growing their portfolio of compressor, vacuum, and pump offerings as well as expand their presence in other underpenetrated markets, such as India and China.

Together, these deals highlight management’s strategy to increase the software presence in their machinery and grow recurring revenue sales. From their 2023 annual report, they state they are targeting $1 billion of recurring revenue by 2027, up from ~$200 million in 2023. Importantly, they are also remaining focused on compressors and adjacent technologies instead of branching out into entirely new forms of equipment. Many of these new deals are also for products used in areas such as high-tech manufacturing, food and beverage, and medical fields, which helps diversify their revenue exposure away from the more traditional heavy industry, chemical, and energy sectors.

Divestitures

Not long after their merger, Ingersoll Rand also made two divestments in 2021. First, they sold a majority stake in their high-pressure solutions segment, which in turn reduced their exposure to upstream oil and gas markets. Then, they sold off their specialty vehicle technologies segment, which contained Club Car golf, utility, and consumer low-speed vehicles. These segments had adjusted EBITDA margins of 6.3% and 17% respectively in 2020, which were considerably lower their IT&S (22.6%) and P&ST (29.9%) segments at the time.

ILC Dover – A Strategic Turning Point

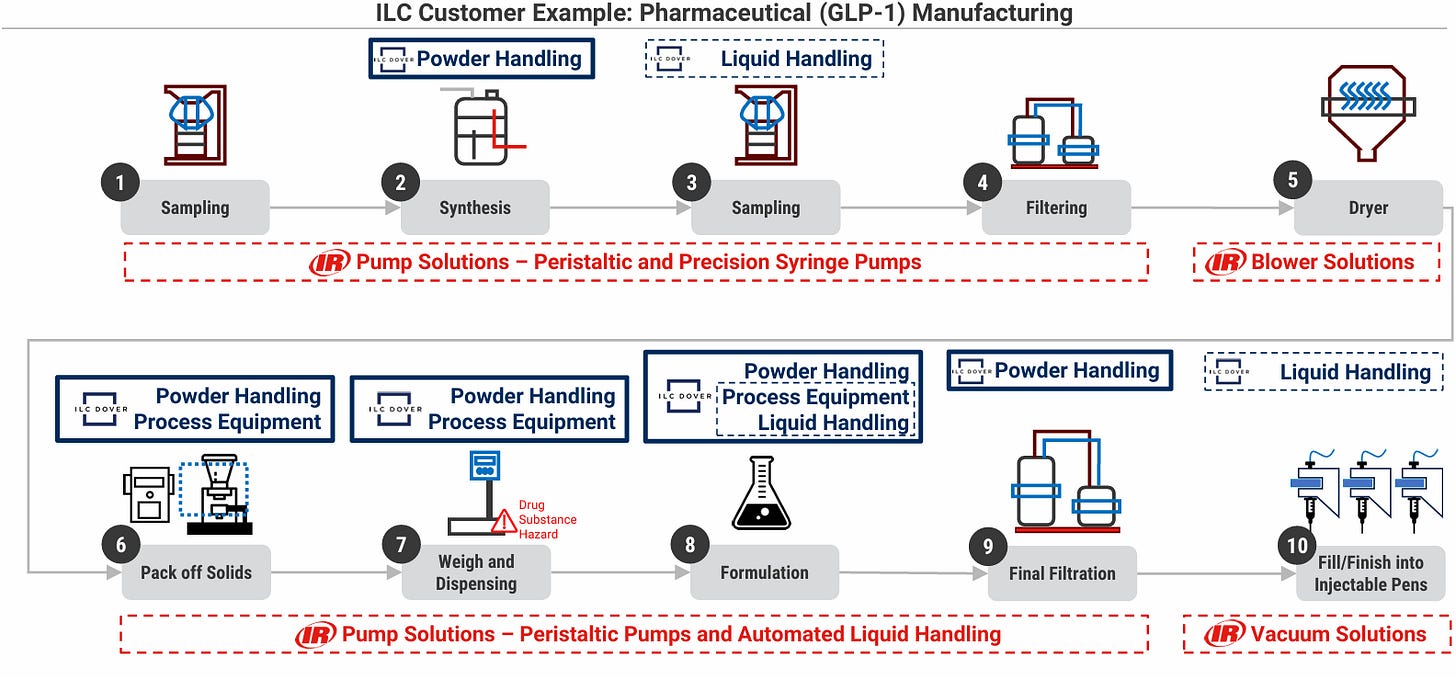

In early 2024 Ingersoll Rand acquired ILC Dover, a life sciences and advanced aerospace manufacturing business for $2.325 billion. ILC Dover predominantly serves the medical industry, providing single-use solutions for biopharma and pharma, and niche solutions for the design and production of silicone, thermoplastic, and specialty rubber components for medical devices. Approximately 75% of revenue comes from consumables or like-for-like replacements, unlocking sizable recurring revenue streams. The rest of the company’s sales come from advanced aerospace manufacturing, such as space suits for NASA. The company is NASA’s leading supplier of space suits, with a partnership going as far back as the Apollo Space Program and Neil Armstrong’s moon landing.

Acquiring ILC Dover marks a likely turning point in the overall direction of Ingersoll Rand and has the potential to be an incredibly valuable long-term strategic move. Besides increasing consumables sales, by moving into life sciences the deal greatly expands Ingersoll Rand’s addressable market and changes the structure of overall the business.

Although the company already had limited exposure to medical markets, on the Q1 2024 earnings call management emphasized that the ILC Dover deal provides a larger platform for the company to continue to build their life sciences business. They also committed to carving out a dedicated life sciences platform within their P&ST segment, which will represent ~41% of P&ST revenue, or ~10% of overall revenue.

Another noteworthy point from the Q1 earnings call was the emphasis on targeting single-use and consumable products as well as identifying product and sales synergies,

"Within the life science end market, we have always targeted the consumable portion of bioprocessing, which focuses on single-use technology, including powder containment, liquid management, tubing and components, isolator protectors and many others. With ILC Dover, we get exactly that, a very clear adjacent market in which we can combine our pumps to build consumables and offer a more complete product portfolio to our customers."

The company believes that the deal will unlock significant opportunity for pull-through on existing pumps and compression technology in addition to access to new customers. An example of these synergies is combining Ingersoll Rand’s peristaltic pump technology with the newly launched ILC Dover tubing technology to deliver liquids to single-use devices which are also made by ILC Dover.

As an added bonus, the acquisition also improves the overall profitability of Ingersoll Rand. ILC Dover is expected to generate adjusted EBITDA margins in the mid-30s, which are higher than the existing Ingersoll Rand business (high-20s). Management states the deal will be immediately accretive to the P&ST segment and expects to achieve a high single-digit ROIC by year three of ownership. Similar to previously discussed industrial acquisitions, this one also grows the company’s percentage of sales from recurring sources.

Future Outlook & Optionality

Ingersoll Rand continues to grow and evolve the business into a higher quality, more profitable, and critically important industrial and science company. The management team has done a great job of using acquisitions to improve recurring sales, grow their IIoT technology platform, and push the business into new, faster growing (and complimentary) life science markets. At the root of this success is Ingersoll Rand Execution Excellence (IRX), a continuous improvement system that has enabled them to optimize and improve their own businesses in addition to newly acquired ones.

As we think about the future, forecasts call for the biopharma market to grow at high single digits through 2030, and the bioprocessing industry to grow low double digits. These growth rates could also accelerate thanks to advancements in artificial intelligence and machine learning leading to faster drug discovery. Looking backwards, bioprocessing sales have grown at a remarkably steady low double-digit rate since 2007, making these projected forecasts both believable and reasonable.

The ILC Dover deal gives the company additional opportunities to cross-sell and vertically integrate their equipment with life science consumables. Ingersoll Rand pumps and compressors delivering fluids to ILC Dover single-use products is a great business model and concept to build around, especially when considering that the existing P&ST segment is about 80% up-front equipment sales.

On the industrial side, which is still most of the business, re-shoring and nearshoring of supply chains should provide a boost in the short to medium term. Despite this market being more mature, the company’s large installed-base of equipment combined with their expansion into their software should enable mid-single-digit growth rates, excluding M&A. As customers upgrade and replace old equipment, they’ll have the opportunity to add-on software monitoring features that will increase overall system uptime and reduce unexpected failures. And as recurring sales increase, total revenue will become less cyclical.

Across the breadth of their operations, there is plenty of room for additional acquisitions. With the dedicated life sciences platform, they now have a segment in the organization to expand upon with new consumable add-ons. In the industrial space, they are likely they continue to look for deals that complement their existing line of compressors, vacuums, pumps, etc. In both markets, there is still considerable market fragmentation, which should give them a wide variety of businesses to target. Company leverage is also relatively low (~0.7x debt/EBITDA), meaning they shouldn’t be faced with financing challenges should they identify new M&A targets.

In their latest annual report, the company has laid out a number of 2027 financial targets. These include low double-digit growth (half organic, half inorganic), low double-digit adjusted EPS growth, adjusted EBITDA margins of 28%-30%, 20% free cash flow margins, and over 30% of products being IIoT-ready. The market seems to have picked up on these targeted achievements, as the stock is currently trading at around 29x to 30x earnings today.

Conclusion

Guided by a highly-skilled management team, Ingersoll Rand has a bright future ahead thanks to their strategic internal investments and targeted acquisitions. The company is focused on growing recurring revenue, expanding their software platform, and increasing their exposure to fast growing life science markets. Strategically, life science markets will provide opportunities to cross-sell integrated solutions that combine Ingersoll Rand equipment with ILC Dover single-use medical products within the same system. While life sciences are still a small part of the overall business, carving out a dedicated platform for it within their P&ST segment shows they are committed to growing their presence in this space.

Ingersoll Rand also continues to invest in and improve the traditional industrial side of the business. Backed by a large installed-base of equipment in mission-critical use cases, the company has ample opportunities to grow software sales that help optimize customer operations and reduce down time. Much of the company’s engineering efforts on the industrial side focus on reliability, energy efficiency, and longevity, all of which help save customers money and reduce waste. They will also continue to acquire businesses that support their compressor ecosystem and increase consumables revenue.

While the present-day valuation of the company is steep, a pull-back in the market may provide a favorable opportunity for investors looking for a growing industrial, science, and technology powerhouse. Given the company’s short history in its current state, it’s difficult to say what sort of multiple it deserves trade at. On one hand, it’s still predominantly an industrial business. On the other hand, they have worked hard to improve the quality of their revenue streams and have a new life sciences platform to grow. Mid to low-20s earnings multiples tend to be where other high quality industrial acquirers trade at over the long-term (such as IDEX, Nordson, and Ametek). However, these businesses tend to have lower organic growth rates than Ingersoll Rand, so perhaps IR deserves closer to a mid-20s multiple.

Supporting Visuals

Relevant Links & Sources

ILC Dover acquisition announcement

Disclosure

This post expresses opinions solely of the author. The author is not receiving compensation on behalf of and has no business relationship with any company whose stock is mentioned in the post. Data, forecasts, and predictions shared in this post are for informational purposes only and are not guaranteed to be accurate or correct. This post is not an endorsement to buy, hold or sell. Investing carries risk. Always do your own due diligence before making investment decisions or putting capital at risk in the market.