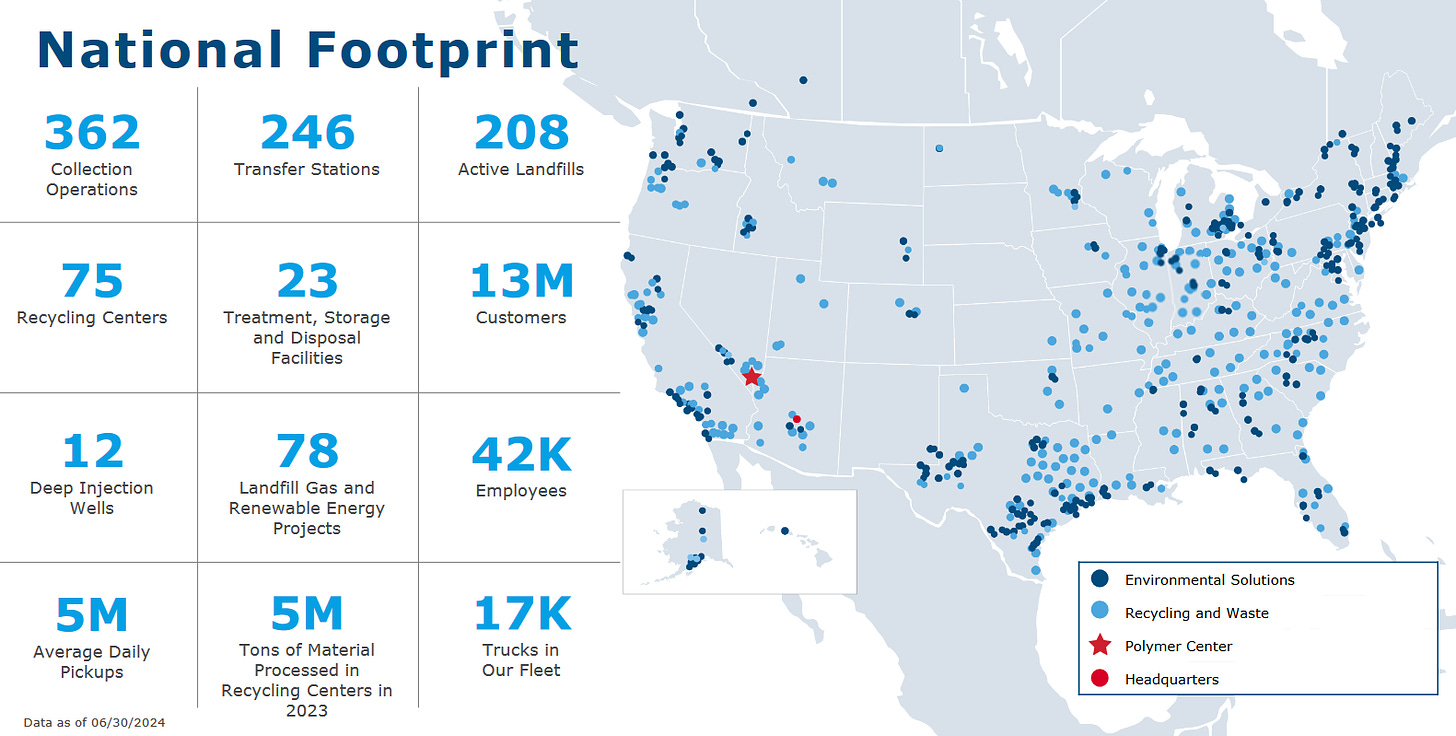

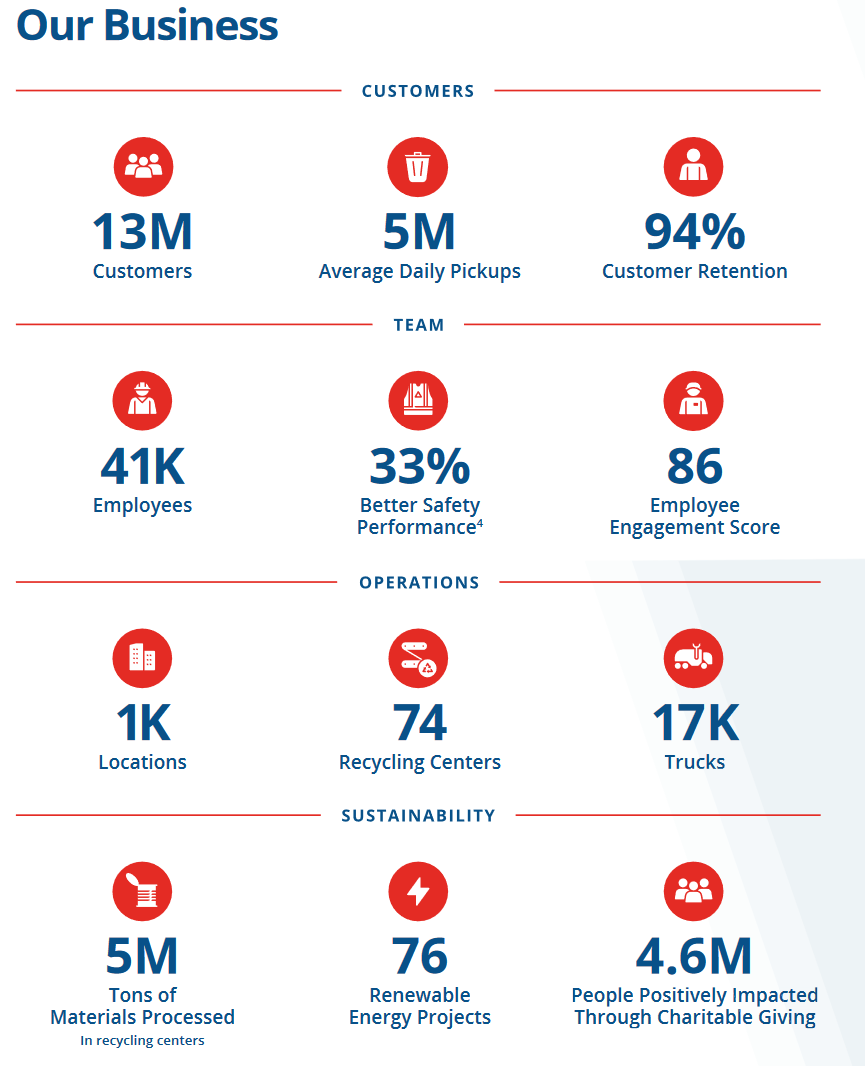

Republic Services (RSG) RSG 0.00%↑ is a vertically integrated provider of waste hauling and environmental services in the United States and Canada. As of FY2023, RSG operates 207 active landfills, 246 transfer stations, 74 recycling centers, and an assortment of various other treatment and storage facilities. Company operations involve an average of 5 million daily pickups, serve 13 million customers in more than 40 states, and utilize 17,000 trucks. Over the past several years customer retention rate has remained steady at around 94%.

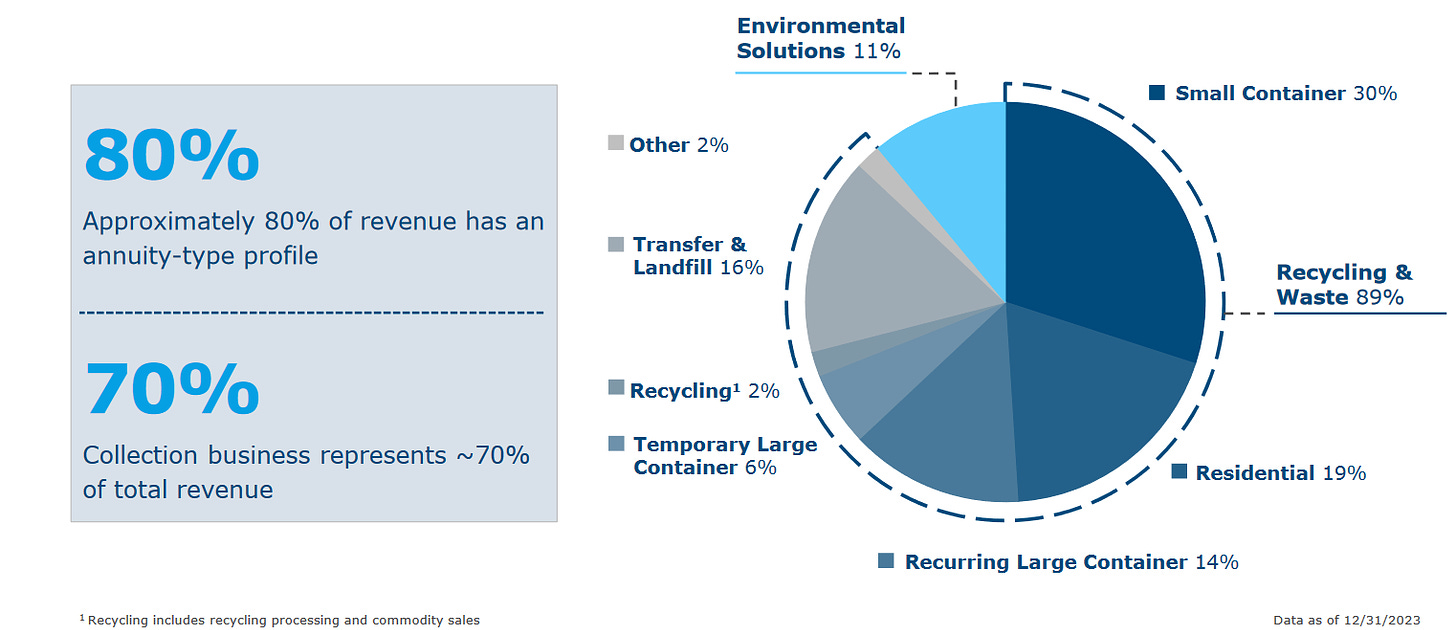

Revenue for the company can be broken down as follows: 69% is from the waste collections business, 5% from transfer station tipping and disposal fees, 11% from landfill tipping fees, 11% from environmental solutions, 2% from the sale of recycled commodity materials, and 4% from other operations. For 2023, approximately 68% of solid waste volume was deposited into landfills that Republic Services owns or operates.

Vertical Integration

Building an expansive network of waste handling facilities in centralized locations is front and center to RSG’s overall success. The general strategy with the business is to vertically integrate and internalize their operations by collecting the waste, delivering it to their own transfer stations to be sorted and combined, and sending it to their landfills and recycling centers. By owning all steps of the process, they can reduce operating expenses and optimize day-to-day scheduling.

RSG also focuses on consolidating market share in the regions they operate in. The company aims to be the #1 or #2 player in their markets and has stated they are willing to divest segments where a path to 1st or 2nd isn’t feasible. Through regional consolidation, they can increase the route density and utilization of their trucks, creating greater efficiency, better service, and improved profitability for the business.

The location of disposal locations is also crucial to their success. Landfills and transfer stations located close to daily collection routes offer cost savings by reducing the total distance trucks need to travel. Centralized transfer station locations are especially important, as the added time and money spent consolidating waste requires high volumes and throughput. Additionally, owning landfills in optimal locations allows RSG to charge lucrative fees to competitors that either don’t own similar assets or are running routes too far away from their own disposal sites.

In today’s world, replicating a network of assets similar to RSG’s would be extremely difficult, if not impossible. Besides the capital costs, both landfills and transfer stations require permits to operate. Permits for new landfills in particular are especially difficult to obtain. Similar to Martin Marietta and its quarries, landfills are unsurprisingly unpopular with nearby residents due to increased truck traffic, noise, and environmental hazards. Due to fierce opposition and not-in-my-backyard policies, the number of landfills nationwide has shrunk from 10,000 in 1980 to 1,500 today (from Morningstar).

Environmental Investments

In recent years, Republic Services has focused on making sizable investments in environmental initiatives aimed at both cleaner and more efficient operations. The company has a total of 76 active gas-to-energy projects covering more than 87% of landfill acreage as well as renewable energy projects. The majority of these projects were developed and are owned by a third party where RSG earns a royalty based on renewable energy sold. There are also an additional 50 projects currently in development through a joint venture with Archaea Energy.

These gas-to-energy systems capture renewable natural gas (RNG), which is a low-carbon, pipeline-quality fuel that’s fully interchangeable with fossil fuel-derived natural gas. 20% of the company’s current vehicle fleet, and 13% of replacement vehicles purchased in 2023, run off compressed natural gas (CNG), which can be substituted with RNG. These vehicles have a higher upfront cost but lower fleet operating costs since they are able to use fuel produced from their own landfills. In addition to CNG, RSG is also piloting electric fleet vehicles.

In 2023 the company opened its first polymer center in Las Vegas. With its launch, RSG will become the first company to manage plastics from curbside collection to recycling to production of consumer packaging materials. The facility is expected to produce more than 100 million pounds per year of recycled plastic, including food-grade polyethylene terephthalate (PET). There are also additional plans for a new plant to make recycled resins for consumer packaging and other applications.

Investment Thesis

Republic Services is a relatively resilient business with defensive characteristics that help during market downturns. Waste collection is similar to water and electric utilities in that they are essential services for communities regardless of economic conditions. To further reduce volatility, RSG establishes long-term contracts with municipalities and exclusive franchise agreements. Contracts are also tied to inflation, which helps protect the business’ profitability during times of monetary turbulence. During better times, growth in solid waste is generally tied to population and economic growth through increased housing construction, higher commercial business activity, and more infrastructure spending.

RSG’s non-replicable facility network also creates substantial barriers to entry for new competitors in the industry. Even with sufficient capital, overcoming regulations to building a similar network of landfills and transfer stations would be nearly impossible. Only other large operators like Waste Management and Waste Connections can compete at a large scale with Republic Services, which often leads to regional duopolies and oligopolies.

Management believes the total addressable market for the company is ~$114 billion, of which ~$83 billion is US recycling and solid waste, and $31 billion is broader environmental services. In 2023 Republic Services generated $15 billion of revenue while their #1 competitor Waste Management generated a little over $20 billion. In total, the largest players make up about 40% of the industry while the rest remains fragmented. Environmental solutions are especially fragmented, although profitability in this segment is well below the traditional waste operations. In 2022 RSG acquired US Ecology, a leading provider of treatment, recycling and disposal of hazardous, non-hazardous and specialty waste to further expand their presence in this area of the market.

Besides competitive advantages and predictable contract-based revenue, there are several growth levers for the business to pursue. First, fragmentation in the waste and environmental services market provides opportunities to expand through M&A. Management has stated they view quality acquisitions as the most long-term shareholder value creation tool (compared to internal investments), indicating more deals are likely to occur in the coming years. Acquisitions can be used to improve route density, expand the company’s network of facilities, and drive volume growth.

Price increases in both service contracts and tipping fees are another avenue for growth. Landfill scarcity will continue to provide increased pricing power for facility owners, with historical price increases consistently exceeding inflation and that trend unlikely to change.

And lastly, expansion of recycling capabilities and polymer manufacturing could drive greater sales growth. With the production of higher-quality packaging and food grade polymers and resins, these plastics are more valuable and can be sold at higher prices compared to raw materials. As recycling continues to grow in importance, more plastic volume will be processed through RSG facilities.

Besides top-line growth, reducing operating costs is another way the company can grow profits. As their fleet of CNG vehicles grows, they can generate significant fuel savings for the company. Electric trucks, while still a proof-of-concept, could also reduce costs. Powering facilities with their own renewable energy projects, increased automation, and enhanced digital capabilities are all areas the company is currently investing in. However, it’s worth keeping in mind that many of these investments still have a way to go before proving they add value.

Risks

There are several risks for Republic Services worth mentioning. One of the biggest is risks involved with mishandling and mismanaging of landfills, toxic waste, and other environmental hazards. These could lead to costly fines, litigation, and reputational troubles for the business. While currently a small portion of total sales, volatility around recycled commodity prices also has the potential to create challenges. Reductions in total waste as a result of environmental initiatives could also slow top-line growth. Increased operating costs from higher recycling standards, environmental regulations mandating cleaner trucks, and enhanced RNG capture systems could weigh on the business’ profitability. And lastly, by engaging in frequent M&A, Republic Services faces risks including overpaying for deals and integrating those operations into their existing business.

Conclusion

Republic Services provides an essential service and operates a non-replicable network of waste hauling and collection facilities. In most end markets, the company operates as a duopoly or oligopoly. Limited competition combined with increasing landfill scarcity gives the business strong pricing power. The company is a dominant player in a relatively fragmented market and openly talks about making deals to grow their market share.

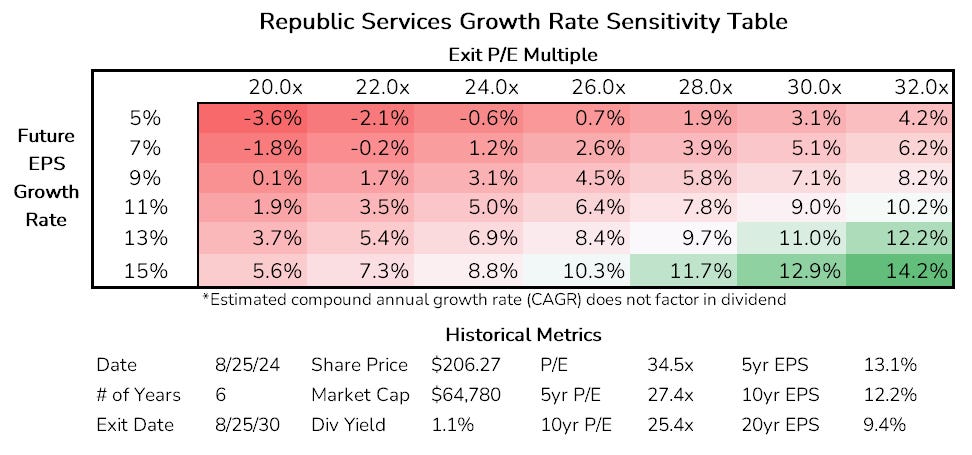

With its strong competitive advantages being well-known, the stock is not a secret and trades at a premium valuation. Sales growth is relatively low but also doesn’t decline much during economic slowdowns. EPS growth has accelerated in recent years and is forecasted to continue to grow at a low double-digit rate over the next several years. That being said, 34x earnings for a historically 4%-5% top-line grower is a lot to ask, even if revenue growth can accelerate higher towards 6%-7% over the next decade. Owning shares in a defensive company like RSG makes sense as part of a balanced portfolio, but current valuations would likely fail to yield double digit returns over a medium-term holding period.

Supporting Visuals

Relevant Links & Sources

Morningstar – Republic Services

Disclosure

This post expresses opinions solely of the author. The author is not receiving compensation on behalf of and has no business relationship with any company whose stock is mentioned in the post. Data, forecasts, and predictions shared in this post are for informational purposes only and are not guaranteed to be accurate or correct. This post is not an endorsement to buy, hold or sell. Investing carries risk. Always do your own due diligence before making investment decisions or putting capital at risk in the market.