Ecolab – A Cleaner, Safer, and Healthier World

One of the most attractive qualities of a business is its ability to generate recurring revenue. Whether it’s through software subscriptions or selling a machine and the materials processed by the machine, it allows a company to sell more products to existing customers at a more frequent rate without requiring new capital purchases. This sales model adds predictability and stability to a company’s cash flows. Ecolab ECL 0.00%↑ , a global sustainability leader offering water, hygiene and infection prevention solutions and services generates 90%+ of revenue from consumables, leveraging the commonly referred to “razor-razor blade” business strategy.

Business Overview

Ecolab is a highly diversified business with operations broken down into four segments serving 16 different industries in over 150 countries worldwide. Based on the company’s website, those 16 industries contain a total of 78 individual end markets with each market offering several to several dozen different solutions. The company’s consumables, equipment, and operations primarily focus on water-related use cases, particularly safety and reducing waste. Core technologies include antimicrobials, clean-in-place (CIP) technology for food processing lines, corrosion control, hard surface cleaners, polymers, food safety interventions, warewashing and sanitation product lines for laundry, food processing, dairy, and healthcare, software and digital solutions, and water treatment.

In short, the company’s business strategy boils down to selling chemical consumables (like antimicrobials, surface cleaners, and filters), selling equipment that runs off of consumables (such as washing machines and dishwashers), digital solutions to help facilities manage and monitor their water usage, and supporting business services. 70% of total company sales are water-related.

A little over half of total sales are to North America, with another quarter going to Europe and the rest split between Asia Pacific, China, and Latin America. The lower percentage of sales in developing markets aligns with lower regulations on quality control that are seen outside of North America and Europe. As other economies mature, demand will rise for the sorts of products and services Ecolab provides.

The company covers a lot of end markets, but here is a very general breakdown of each segment:

Global Industrial includes water treatment and cooling solutions, food & beverage cleaning and sanitizing solutions, and paper & pulp. 90% of sales in this segment are water-related.

Global Institutional & Specialty serves institutional clients such as hotels, casinos, governments, and educational facilities as well as restaurants and grocery stores. 70% of sales in this segment are water-related.

Global Healthcare & Life Sciences provides infection prevention, surgical solutions, end-to-end cleaning solutions, and contamination control. Ecolab’s life science business also includes its Purolite and Bioquell brands. 20% of sales in this segment are water-related.

The Other segment includes Ecolab’s pest elimination business, textile care products and services used for commercial laundry operations, and their Colloidal Technologies Group (CTG).

All of the segments offer some sort of digital and software solutions, whether that be for monitoring water usage, managing chemicals and fluids, compliance, or food tracking and management.

Capitalizing On Global Trends

Based on the products and services Ecolab provides, the company is at the forefront of several key environmental trends. Factors such as climate volatility and population growth will continue to increase demand for fresh water and energy. Estimates forecast that the world will need 40% more fresh water, 35% more food, and 30% more energy by 2030. In order to meet these demands, countries and corporations will need to use existing resources more efficiently.

Ecolab’s corporate initiative to reduce customers’ environmental impact will be a key driver of improved resource usage, especially water. The company’s products, digital solutions, and services all contribute to this cause while simultaneously reducing customers’ operating expenses. Governments around the world continue to strengthen rules and regulations surrounding water usage, pollution, and cleanliness standards. Companies that fail to adhere to these new requirements risk negative publicity as well as economic punishment. ESG trends could also potentially impact a business’s access to external capital, making it essential that they operate in a clean and responsible manner.

In order to track their progress, Ecolab measures the impact of their solutions using a metric called “eROI,” which they describe as the exponential value of improved performance, operational efficiency, and the sustainable impact. This metric is used to document operational, economic and resource savings related to water, energy, air, waste, asset protection and safety. In 2023, Ecolab calculated its impact as saving 226 billion gallons of water, avoiding 3.8 million metric tons of CO2, feeding 1.4 billion people high-quality and safe food, and cleaning 60 billion hands.

Building Up & Buying Out

Ecolab grows their business through two primary strategies, acquisitions and internal reinvestment. The company tends to make several acquisitions per year, most being small tuck-in deals. When it comes to acquisitions it’s important to determine whether or not management is making deals that complement the existing business or if they are chasing a growth at an any cost outcome. Ecolab’s leadership, similar to Ingersoll Rand’s, has done a skilled job of strategically targeting high value areas with their deals.

In 2017, Ecolab acquired three pest control businesses that specialize in food storage in order to expand their extermination segment for restaurants, food and beverage processors, and grocery stores. In 2018 they acquired Bioquell, a decontamination systems and services company that operates in the life sciences and healthcare industries. In 2020 they acquired a livestock biosecurity and hygiene provider, and in turn formed a new animal health division by combining this company with the rest of their animal health operations. In 2021 they bought Purolite, a separation and purification solutions provider for both life sciences and industrial applications. They also made other various cleaning solution and water treatment deals over this time.

In parallel with acquisitions, Ecolab has also focused on internal reinvestment to grow and improve the business. They usually launch several new products per year ranging from water testing to disinfectants to enhanced washing machines for dishes and laundry – designed to improve cleaning capabilities but also reduce water and energy usage. In 2019 the company launched its ECOLAB3D cloud platform for enterprise-wide industrial water management. This platform is focused on optimizing water utilization, reducing excess water use, and ultimately saving customers money.

Ecolab also recently launched a new digital solution called CoreTemp, a system designed for improving hospital cleanliness and patient health. CoreTemp is used for monitoring fluid volumes and temperatures during surgical procedures, keeping patients safe, optimizing hospital fluid allocation for complications such as blood loss, and reducing operating room preparation time.

In 2023 Ecolab announced it would be expanding Purolite’s manufacturing capabilities with a new biologics resin manufacturing facility in Pennsylvania. This added production will help strengthen the company’s supply chain and further increase availability of these resins to biotech and pharmaceutical customers. This strategic initiative also highlights the company’s ability to acquire a successful company, invest back into that business, and further improve its operations beyond what it may have been capable of doing itself.

Besides growth and expansion, Ecolab is also willing to divest segments that aren’t a best fit for the business. In 2018 they sold off their industrial phosphonate chemical business in China as well as their oilfield equipment fabrication unit. Keeping the company focused on its highest value end-markets and product lines is a key factor in achieving long-term, continued success. In terms of the company’s filtration, cleanliness, and water management solutions, there is carryover between designs for different industries. This carryover optimizes research and development spending, capital expenditures, and helps prevent the company from becoming overly diversified, bloated, and inefficient.

Future Outlook & Optionality

Backed by key global initiatives, Ecolab’s ability to deliver successful results through both internal reinvestment and acquisitions gives the company a favorable long-term roadmap. On one side, business units like Purolite are experiencing growing demand, strong enough that expanding their manufacturing footprint is an effective use of capital. At the same time, industry fragmentation provides opportunities for additional acquisitions and consolidation. Fragmentation also provides opportunities to simply out-compete smaller competitors that can’t match the scale and breadth of Ecolab’s solutions.

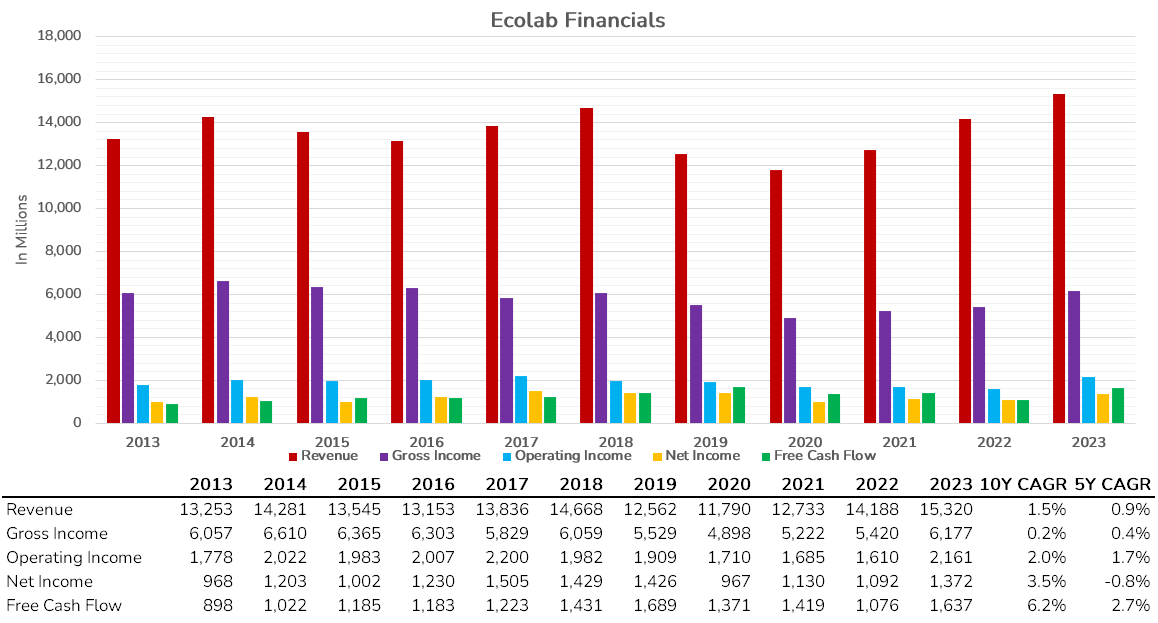

In terms of financial goals, management is targeting long-term sales growth of 5-7%, 20% operating margins, 12-15% EPS growth, and 90-100% FCF conversion of net income. The company believes they have approximately a 10% market share in a $152 billion industry. Specifically, they call out penetration to existing customers being a $55 billion opportunity and unsold customers being a $82 billion opportunity. Cross-selling existing products (or as they call it, “circling the customer”) as well as out-competing smaller competitors offer a long runway to grow sales in both of these categories. Additional acquisitions can also help them capture share, or even expand that addressable market.

While growth has been slow in recent years, less than management’s targets, the tailwinds surrounding clean water and improved hygiene seem likely to reverse that trend. In developed markets, which account for ~75% of sales, businesses and governments will be forced to upgrade existing infrastructure and processes to comply with rising standards. In emerging markets, standards for water usage, water quality, and sanitation tend to be lower than that of western nations. However, those metrics are rapidly improving, which will open the door for Ecolab to acquire new customers and increase sales penetration.

With such a high percentage of sales coming from recurring consumables, the company should have a relatively predictable forecast of future cash flows. This can help them better allocate for acquisitions, internal reinvestments, managing debt, and returning capital to shareholders through buybacks and dividends. The company has currently increased dividends for 32 consecutive years and returned ~$10 billion to shareholders from 2013 to 2023, $4.5 billion of that being in the form of buybacks.

Risks

Given the vast number of industries and markets that Ecolab serves, one potential risk the company could encounter are smaller, more agile competitors targeting specific niches with better products. It’s unlikely that any single competitor could ever disrupt the entire company, but over time, similar to Nike’s ongoing struggles in athletic apparel and footwear, many competitors specializing in certain areas could erode Ecolab’s overall position.

This seems like a low/unlikely risk, but it also wasn’t too long ago that everyone felt Nike was far and away the best name in its industry. Management will need to continue their track record of establishing and maintaining deep customer relationships, offering superior products, providing solutions that lower customer operating expenses, and leveraging their size and scale to out-innovate and out-compete smaller peers.

Another risk that applies to any company that engages in frequent acquisitions is poor capital allocation. This can come from overpaying for deals or expanding into non-adjacent, non-complementary industries. Ecolab’s management team has done a good job so far, keeping deals focused on consumables-based water, purification, and disinfecting solutions. However, expanding into new end-markets or acquiring new, unrelated technologies that don’t synergize with the core portfolio could hurt business performance. Unchecked expansion runs the risk of creating underperforming business segments, fragmenting internal investment spending, and creating a bloated and complex management structure.

Conclusion

Ecolab is a high-quality, highly diversified business driven by over 90% consumables revenue. The company’s products and services are used at nearly 3 million customer locations worldwide to satisfy demands for clean water, safe food, and healthy environments. In addition to the safety and cleanliness benefits, Ecolab’s solutions also lower customers operating expenses. With environmentally responsible government policy and initiatives continuing to rise in popularity, the company has impactful tailwinds supporting it for the next decade and beyond. To capitalize on these trends, Ecolab will continue to leverage a combination of complimentary M&A and internal reinvestment.

The company trades at a relatively high premium valuation today, currently at around 38x earnings. This sounds high, but in the five years prior to the pandemic the company averaged around 28x earnings. Looking way back, the company traded at around 29x earnings from 2004 through 2007. In general, the company always tends to trade at high valuations due to the perceived high quality and high consumable nature of the business. The current valuation is certainly a bit stretched, but some of that premium can be attributed to earnings and margins continuing to rebound relative to pre-pandemic levels.

That being said, double digit returns will likely be a challenge to achieve at today’s stock prices. The company is not a high growth, high margin business even during the best of times. The strength of the business comes from the relatively durable and predictable cash flows and the defensive catalog of essential products and services. Organic growth may improve in the upcoming years, but they’re still unlikely to ever achieve sustainable double-digit top-line growth. Earnings growth was severely impacted during the Covid19 pandemic years, and EPS is only expected to surpass their 2019 highs this year.

To be a worthwhile investment, they’ll probably need to generate closer to ~7% top line growth, at least high-single-digit EPS growth (after recovering margins from pandemic disruptions), and maintain a high multiple (30x seems plausible). But even then, that may not be enough to deliver 10%+ returns.

Supporting Visuals

Relevant Links & Sources

Disclosure

This post expresses opinions solely of the author. The author is not receiving compensation on behalf of and has no business relationship with any company whose stock is mentioned in the post. Data, forecasts, and predictions shared in this post are for informational purposes only and are not guaranteed to be accurate or correct. This post is not an endorsement to buy, hold or sell. Investing carries risk. Always do your own due diligence before making investment decisions or putting capital at risk in the market.